Understanding PrimeXBT Funding: How It Works and Why It Matters

The world of cryptocurrency trading is both exciting and complex. One key aspect that often confuses traders is funding, particularly the PrimeXBT Funding PrimeXBT funding mechanism. This article aims to clarify funding in relation to PrimeXBT and provide insights on how to navigate it effectively.

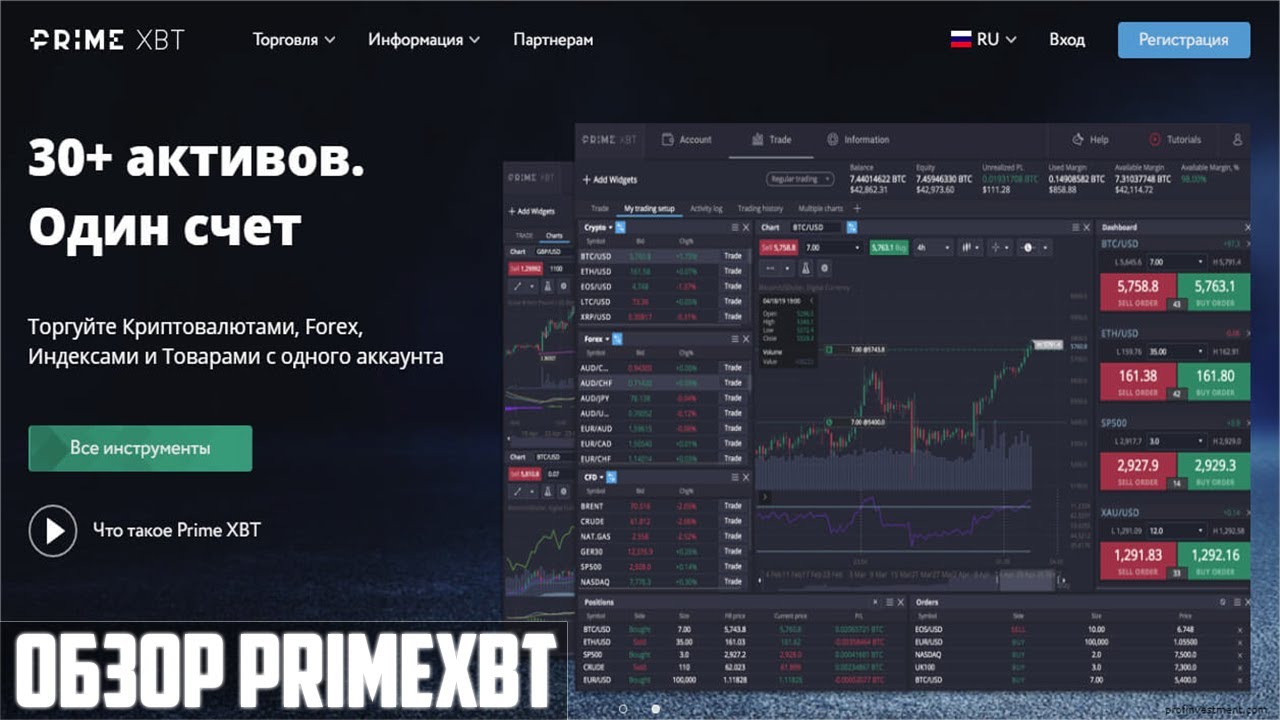

What is PrimeXBT?

PrimeXBT is a popular cryptocurrency trading platform that allows traders to invest in various assets, including cryptocurrencies, commodities, and forex. It is known for its user-friendly interface, advanced trading options, and extensive educational resources. One of the essential components of trading on PrimeXBT is understanding funding, which is vital for optimal trading performance.

The Importance of Funding in Trading

Funding refers to the interest or fees associated with holding leveraged positions. When you trade with leverage, you borrow funds to increase your position size. While this can amplify your profits, it also means you’ll incur funding fees, which can impact your overall profitability.

Understanding these funding fees and knowing how to manage them is crucial for traders looking to succeed on platforms like PrimeXBT. Effective management of funding costs can make the difference between a profitable trade and a losing one.

How PrimeXBT Funding Works

On PrimeXBT, funding fees are calculated based on the open positions you hold. The platform operates on a system where traders pay or receive funding fees every eight hours, depending on the market conditions and their positions’ direction.

Calculating Funding Fees

Calculating funding fees is straightforward but requires constant attention as they can vary based on market dynamics. The funding rate is determined by various factors, including interest rates and market demand. Primarily, the funding fee is expressed as a percentage and applied to your position size.

To calculate the funding fee for your open position, you can use the following formula:

Funding Fee = Position Size × Funding Rate

For example, if your position size is $10,000 and the funding rate is 0.02%, your funding fee would be $2 for that period.

Types of Funding Rates

There are two main types of funding rates on PrimeXBT:

- Long Funding Rate: This rate applies if you are holding a long position in the market. If this rate is positive, you will pay a fee to short position holders. Conversely, if it is negative, you will receive a fee.

- Short Funding Rate: This applies to those holding short positions. Similar to the long funding rate, a positive short funding rate means you pay a fee to long position holders, while a negative value allows you to collect a fee.

Factors Influencing Funding Rates

Several factors can influence funding rates on PrimeXBT:

- Market Volatility: High volatility can lead to significant shifts in funding rates, impacting how much traders pay or receive.

- Supply and Demand: The balance of buyers and sellers in the market affects funding rates. If there are more traders holding long positions, the long funding rate will increase, and vice versa.

- Interest Rates: PrimeXBT funding rates are also influenced by the broader market interest rates and the cost of capital associated with borrowing funds.

Managing PrimeXBT Funding Costs

Managing funding costs is essential for maintaining profitability in trading. Here are some tips to help you optimize your funding expenses on PrimeXBT:

- Monitor Funding Rates: Keep a close watch on the funding rates for both long and short positions. Understanding the trends will help you make informed decisions on when to enter or exit your trades.

- Choose Your Positions Wisely: Consider the potential funding costs when deciding between long and short positions. Balancing your portfolio can help mitigate high funding fees.

- Utilize Stop-Loss Orders: Implementing stop-loss orders can help you minimize losses and manage your positions more effectively, ultimately reducing the duration of funding fees incurred.

Conclusion

In conclusion, understanding PrimeXBT funding is essential for every trader using the platform. By familiarizing yourself with how funding works, how to calculate fees, and what influences funding rates, you can optimize your trading strategy and improve your profitability. Whether you’re a novice trader or an experienced veteran, taking the time to grasp these concepts will serve you well on your trading journey.

Trading is not just about predicting market movements; it also involves understanding the costs associated with those trades. With a solid grasp of PrimeXBT funding, you can approach your trading endeavors with confidence, knowing you’re equipped to handle funding fees effectively.